Effective risk control is essential for successful trading, and one of the most powerful tools in a trader's arsenal is the Stop Loss. At 24Funded, we provide advanced Stop Loss features to help traders manage their risks and protect their capital.

Scroll Down

Scroll Down

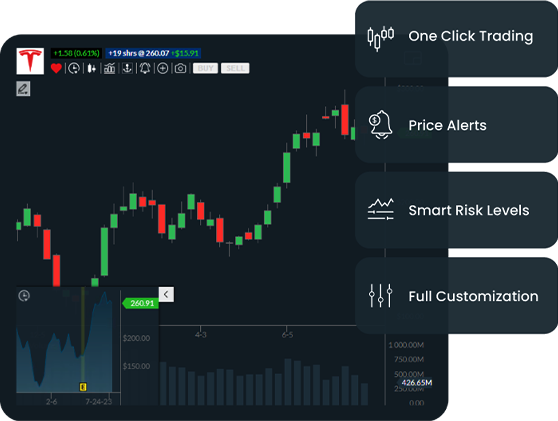

Key Features of

THE INDICATOR

Customizable Stop Loss Options

Choose between Fixed, Trailing, and Guaranteed Stop Losses to tailor your risk management strategy to specific market conditions.

Real-Time Adjustments

Modify your Stop Loss levels instantly based on live market data, ensuring your strategy adapts to changing conditions.

Comprehensive Risk Analytics

Access detailed insights and analytics to monitor and optimize your risk exposure across all your trades in real-time.

Why Use

How to Get Implement It

Implementing a Stop Loss in your trading strategy is essential for safeguarding your investments. By setting predetermined exit points, you limit potential losses and protect your capital from unexpected market shifts.

Risk Management:

A Stop Loss is a key component of any risk management strategy, allowing traders to predetermine their maximum loss on any given trade.

Emotional Control:

By setting a Stop Loss, traders can avoid making emotional decisions during volatile market conditions, sticking to their planned strategy instead.

Focus on Opportunities:

With the safety of a Stop Loss, traders can focus on finding new opportunities without constantly monitoring every open position.

Implementing Stop Loss with 24Funded

Easy Integration:

Set Stop Loss orders with just a few clicks directly from the trading interface.

Advanced Features:

Access trailing and guaranteed Stop Loss options to enhance your risk management.

Real-Time Adjustments:

Modify your Stop Loss levels in real-time as market conditions change.